RegTech – Compliance and Cybersecurity: The New IT Paradigm

RegTech – Compliance and Cybersecurity: The New IT Paradigm

Cyvatar | 03/15/2022The regulatory landscape of today is quite challenging. Financial firms are dealing with higher frequency in regulatory changes, tougher penalties on non-compliance, and greater complexity.

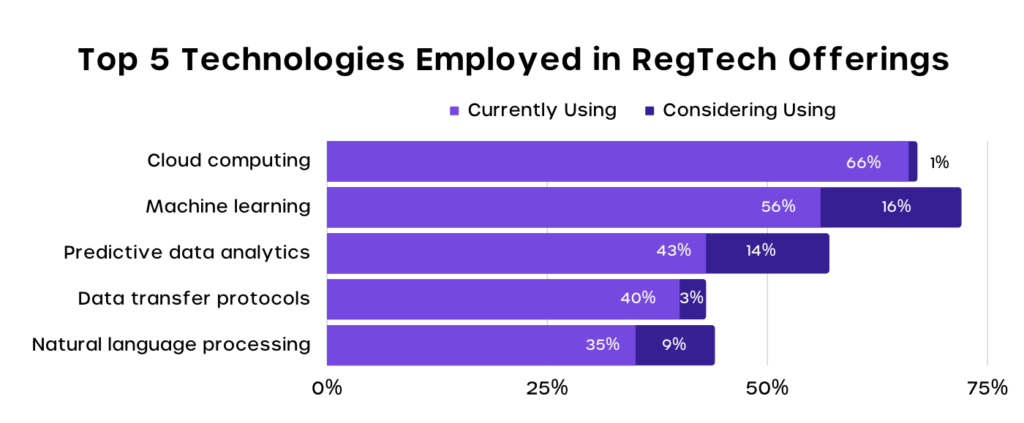

Since 2008, average regulatory updates per day have increased from 10/day to 220/day in 2019; per a recent report by Thomson Reuters, while monitoring regulatory changes over a decade.

Hence, the rapid interest in regulation technology should be of no surprise.

Regtech is not only helping financial firms comply with regulations and laws but also assisting non-financial firms in meeting obligations to compliance from various sectors, such as environmental regulations, customs regulations, and labor laws.

But what started the regulatory revolution of today?

The Global Financial Crisis (GFC) in hindsight set in motion much-needed regulatory reforms to govern financial institutions.

The regulatory changes brought by the federal government increased scrutiny along with increased fines for the financial institutions while helping to earn back people’s trust in these institutions.

Key Regulatory Events Which Shaped the Regulatory Environment of Today

The post-crisis reforms sped up digital transformation in the financial sector, with the emergence of new products, services, and business models based on the latest technological innovations.

The integration of technology with financial service offerings (fintech) helps improve their efficiency while delivering a bespoke customer experience.

While the future of fintech in the U.S. is promising, it is also subjected to increased regulations, sanctions, and legal actions.

On one hand, Fintech equips financial firms to zoom ahead by hopping on the Digital Transformation (DX) bandwagon.

On the other, it is being anchored down by the additional regulatory checklists for compliance it brings about.

Enter – Regtech, which brings the promise of technical solutions to ensure organizations remain compliant in raising financial risk management and regulatory obligations for an effective business process.

Regtech is the application of artificial intelligence, machine learning, and advanced fintech technologies to ensure organizations comply with regulatory requirements through automating functions of regulatory management.

The major functions pertaining to regulatory management performed by Regtech are monitoring, reporting, and compliance.

While the initial implementation of Regtech began in the financial institutions; where ever-changing regulatory requirements made it extremely difficult to comply especially with human intervention, it has made way into a wide number of sectors beyond finance, such as mining, energy, telecom, and health, where it helps to meet requirements of increasingly complex regulatory architecture.

Technologies such as AI and ML helped scan thousands of pages of new and old regulations and highlighted to managers only those high-hanging fruits which needed their intervention or ones which pertained to be complied with according to the business nature.

Benefits of Regtech to Fintech Organizations

- Savings: Regulation technology helps large and small fintech companies to save money, time and effort.

The true cost of non-compliance to an organization is 14 million USD, while the cost of non-compliance in terms of fine averages at 2 million USD.

The real cost lies in the disruption caused to business, revenue loss incurred, productivity lost and reputation damaged in industry and with customers.

You might be wondering how it stands against the cost of compliance. Actually, the cost of the compliance is way less than that of the cost of the compliance.

The study by Globalscape and Ponemon makes it clear how costly non-compliance is as compared to compliance.

| Non-compliance cost consequences | Minimum | Median | Average | Maximum |

|---|---|---|---|---|

| Fines, penalties & others | – | $1,100,500 | $1,955,674 | $5,301,500 |

| Revenue loss | – | $3,995,194 | $4,005,116 | $19,176,931 |

| Productivity loss | $997,600 | $4,667,300 | $3,755,401 | $17,336,500 |

| Business disruption | $1,100,745 | $4,232,786 | $5,107,206 | $20,396,716 |

| Overall | $2,098,345 | $13,995,780 | $14,823,397 | $62,211,647 |

Total Cost of non-compliance in USD

Not to mention the immeasurable loss of reputation incurred.

| Activity centers | Minimum | Median | Average | Maximum |

|---|---|---|---|---|

| Policy | $0 | $296,032 | $399,601 | $583,421 |

| Communications and training | $45,600 | $289,669 | $378,590 | $1,711,992 |

| Program management | $89,104 | $530,219 | $673,010 | $3,303,664 |

| Data security | $287,556 | $1,359,257 | $2,010,800 | $6,592,051 |

| Forensic and monitoring | $356,212 | $832,145 | $1,089,455 | $6,241,897 |

| Enforcement | $106,000 | $663,839 | $917,703 | $7,126,414 |

| Overall | $884,472 | $3,971,161 | $5,469,159 | $25,561,439 |

Total Cost of compliance in USD

- Optimization: 10-15% of staff dedicate their time to regtech in traditional organizations.

If we assign a person to take care of regulatory tasks, it would take 5,077 days for that person to complete the US regulations! That’s how labor-intensive regulatory activities are.

Regtech coupled with AI and ML optimize processes and drive efficiency to decision making ensuring proper use of the human resources.

These stats by Thomson Reuters Compliance Intelligence show that the majority of the teams spend anywhere between 1-7 hours per week of their time amending and updating policies & procedures to reflect the latest regulatory rules.

Imagine what you could do with all the time and people in your organization if this was automated and taken care of.

| Start with automating logging and monitoring to initiate compliance activities with Cyvatar’s managed cybersecurity-as-a-service. |

Besides workflow optimization, there are additional perks in the form of improved safety, technology integration, and data optimization – all of which largely improve an organization’s growth potential.

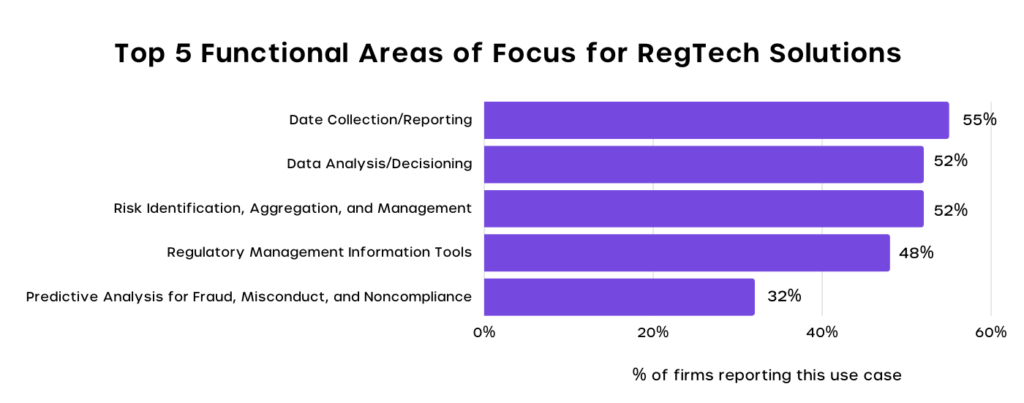

- Technology Modernization: Regulators are adopting cloud at scale with AI and ML to drive operational improvement and real-time insights.

Regulatory and compliance data available on digital platforms encourage organizations to move to the cloud. Adopting and adhering to regulations keep your organization at the forefront of technology.

The use of cloud computing, or utilities provide an opportunity for Fintech organizations to use cutting-edge technology to manage compliance while driving down costs.

- Reduce Operational Risk: Implementation of Regtech helps in the elimination of human errors arising from mechanical and repetitive tasks.

The fast-paced regulatory changes bring about a constant knowledge gap within the organization without regtech support.

The regtech helps keep up with such frequent changes in regulations, ensuring regulatory compliance all the time without any human error.

How will RegTech affect Asset Management?

Regulators are leading regtech implementation to oversee compliance. SEC, for example, post-2015 has been testing the capabilities of Natural Language Processing techniques and algorithms to analyze whistleblower programs.

The acceptance of regtech by regulators further emphasizes the need for Asset Management companies to deploy these solutions, provided a strong enough need did not exist earlier.

Regtech can help asset managers in two ways:

- Automating the production of hundreds of disclosure documents that an organization has to produce throughout the year.

- Filtering the regulations and finding the obligations that impact your business.

Manual creation of these documents is time-consuming, labor-intensive, expensive, and can be subjected to human errors which are detrimental to the very business operations.

Deploying robotic process automation (RPA) helps generate compliance reports periodically without any error.

Asset Management firms need to ensure client managers adhere to the strictest standard of ethical practices, record, and store firm-client conversations.

Machine learning can apply to this vast amount of unstructured data to pick up potential red flags and ensure client managers are adhering to guidelines set out by asset management firms for their internal compliance oversight.

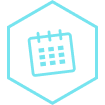

Use Cases of RegTech

- Legal Compliance

Global regulatory compliance spending will increase from just under $278 billion to more than $316 billion over the next five years, per Juniper Research.

Regtech is catching up with the banking sector and the jump in spending of 5 fold from $25 billion to $127 billion in the same period is a validation in itself.

Thanks to the rise in the automation of resource-intensive tasks, such as those involved in KYC (Know Your Customer) checks and increasing use of AI in transaction monitoring.

For the Banking sector, Regtech will help save about $1 billion in automating KYC checks.

- Automated Security Control Status or Cyber Posture Reports

In the ever-changing compliance and technology landscape (adoption of cloud, IoT, mobile applications), there is a growing need to receive security and compliance reports.

Auditor standards such as PCAOB (Public Company Accounting Oversight Board), require auditors to generate security reports from time to time.

The reporting structure and schedule, while time-consuming and cost-intensive, is also open to bias as the security managers who run these reports often overlook the inherent deficiencies/vulnerabilities. Regtech offers a steady, efficient alternative.

- Attack Vector Assessment

Another growing application of regtech is in the assessment of breaches and money laundering prevention.

Regtech solutions enable companies to collect, protect and exchange sensitive data while predicting and preventing breaches and money laundering attacks.

Compliance & Regulatory challenges: With Cybersecurity as a Service

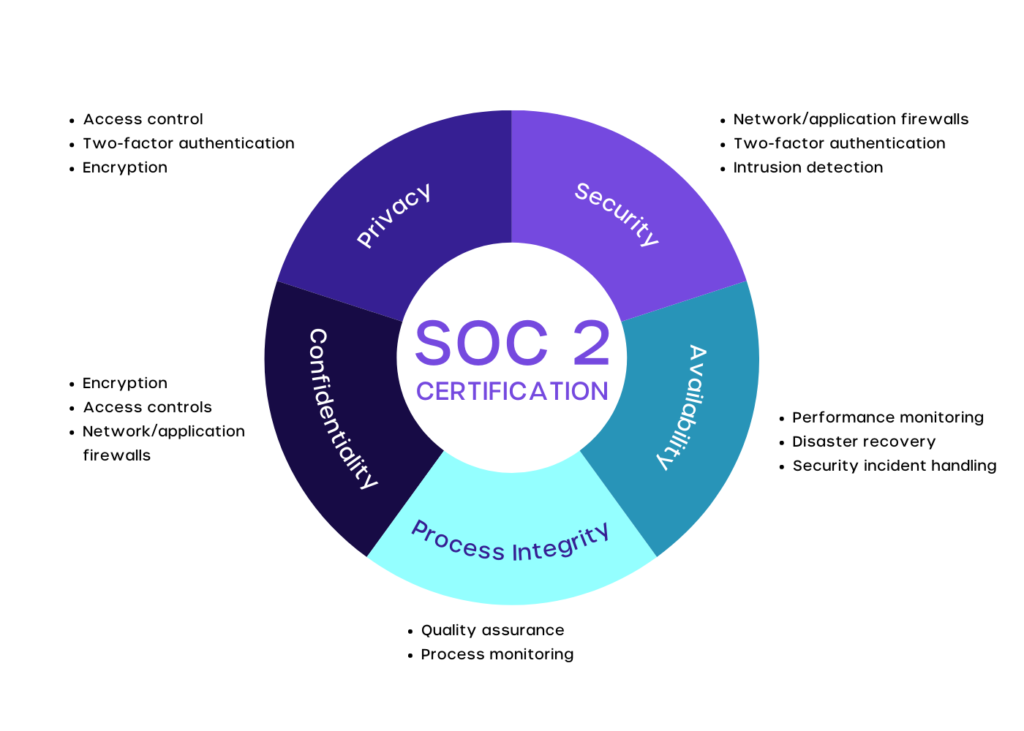

- System and Organization Controls 2 (SOC2) is a trust services criteria defined and audited under standards set by the American Institute of Certified Public Accounts (AICPA).

SOC2 is an auditing procedure that ensures your firm’s service providers are securely managing and protecting your client’s data.

SOC2 encompasses 5 trust principles against which we audit the vendor: security, availability, process integrity, confidentiality, and privacy.

CYVATAR’s CSaaS Solution:

| Cyvatar helps ensure service provider firms comply with SOC2 standards through automated reports and streamlined compliance strategies. |

- Cybersecurity Maturity Model Certification (CMMC) compliance, is a Department of Defense (DoD) proactive measure to safeguard Controlled Unclassified Information (CUI) across the DoD supply chain.

CUI includes financial, legal, intelligence, infrastructure information, and data created or possessed by any entity – government or non-government—on the government’s behalf.

CMMC affects the complete supply chain of vendors and contractors doing business with DoD, who are required to comply with the CMMS framework of processes, practices, and approaches.

CYVATAR’S CSaaS Solution:

| MSSPs like Cyvatar.ai can help vendors and contractors doing business with DoD with resources to comply with CMMC levels of cybersecurity with detailed initial assessments and achieve requirements necessary for passing CMMC Audit. |

- National Institute of Standard and Technology (NIST) is a non-regulatory agency under the purview of the US Department of Commerce whose primary role is to develop standards and best practices that apply to various industries.

NIST standards are quite stringent as it is a compliance framework developed following best practices from several security documents, publications, and organization insights.

Compliance with NIST guidelines helps meet requirements of FISMA, HIPAA, and SOX while protecting the organization against cyber-attacks.

Hence, the benefits of complying with NIST are not limited to federal agencies or manufacturers, or service providers who work with governments but also equip SMBs to tackle cyber-threats.

CYVATAR Solution:

| Complying with the NIST framework might be challenging for SMBs, especially for small businesses. That’s why Cyvatar has included managed SOAR* solution in our all-inclusive security packages: CYBERSECURITY FOUNDATIONS | CYBERSECURITY PREVENTION SUBSCRIPTION | CYBER PREVENTION & CLOUD * We don’t provide MSOAR service separately anymore. |

- Payment Card Industry (PCI) compliance is mandatory for all businesses that process, store and transmit credit card information of customers to ensure the security of credit card transactions in the payments industry.

PCI standards refer to the technical and operational standards developed and managed by PCI Security Standards Council.

Being PCI compliant would be to comply with all the 12 key requirements, 78 base requirements, and over 400 test procedures prescribed by the PCI standards council.

CYVATAR’S CSaaS Solution:

| Cyvatar can help your organization implement all requirements for PCI DSS compliance through the active management of checklists. The Cyvatar approach is rooted in proprietary ICARM (installation, configuration, assessment, remediation, maintenance) methodology that delivers smarter, measurable security solutions and enables members to achieve security compliance and cyber-attack protection faster and more efficiently. |

Learn more about how Cyvatar drives compliance as a byproduct of cybersecurity strategy, delivering streamlined compliance with continuous security and remediation. Get the details by downloading our ebook.