Fraud detection and prevention: Steps to help prevent bank fraud

Fraud detection and prevention: Steps to help prevent bank fraud

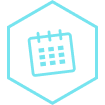

Cyvatar | 03/21/2022Fraud is a recurring problem regardless of whether it affects a financial institution or an individual or a business. Fraud can come in many forms and can be very hard to detect unless certain protections are in place in your organization.

Below is a list of examples of financial fraud that institutions need to be aware of:

- Embezzlement or other types of financial misbehavior

- Property misappropriation, misuse, removal, or concealment

- Forgery, fabrication, or alteration of documents and/or information (e.g., checks, bank draughts, deposit tickets, promissory notes, travel expense reports, contractor agreements, purchase orders, electronic files, and so on) in order to receive an unlawful financial benefit

- Deviations from conventional processes in the management or reporting of money, cash equivalents, or financial transactions, such as the use of a procurement card to get an illicit financial benefit

- Theft or misappropriation of business finances, securities, supplies, inventory, or any other asset (including furniture, fixtures, or equipment, data, trade secrets, or intellectual property)

- Authorizing payment to vendors when it is known that the products or services were not received by the institution with the goal of obtaining an unlawful financial benefit or harming the institution financially

- Falsification of work/employment records pertaining to pay and perks in order to acquire an unlawful financial benefit

- Misuse of resources, such as vehicles, telephones, mail systems, or computer-related equipment, in contravention of institutional regulations in order to acquire an unauthorized financial profit

- Attempting to get an unlawful financial benefit by circumventing purchasing procedures and constraints

- Bribery, kickbacks, or attempting to get illicit rebates with the goal of obtaining an unauthorized financial benefit

- Except as required by institutional policy, accepting money for research or gifts on behalf of the institution or as part of ongoing corporate social responsibility activities

- Attempts to hide or continue the aforementioned acts

Fraud Prevention Tips: How to Prevent Bank Fraud

Financial fraud can occur at any time and place and can happen internally, leaving you vulnerable to further consequences if undetected.

To ensure that it does not happen though, you can follow these five steps as a starting point:

- Risk Assessment

One of the first steps in reducing fraud risk is to conduct an assessment. A thorough assessment, whether performed internally or by a qualified third party, will assist you in identifying any areas of weakness that could be exploited by those looking to commit fraud.

You’ll need to examine your safety procedures and protocols, as well as the training you’ve put in place for your employees.

Out-of-date computer systems become easy entry points for hackers looking to gain access to your data and your customers’ private information. Updating your system may take some time, money, and effort, but is essential to your protection.

Along with updating computers and software, you should ensure that your employees receive comprehensive fraud prevention training with the latest guidelines in place.

- Educate your employees

Major financial institutions have the capability to use advanced cybersecurity systems, run audits and assessments, and improve software for fraud detection and prevention.

That doesn’t mean that every business can afford this kind of technology. That is the reason to democratize cybersecurity.

Alternatively, lack of information and education has led to consumers doing inadvertent activities that can put them and your business at risk.

It’s for this reason that educating your customers about the consequences of fraud and how important it is to be wary and not become a victim of fraud.

You can educate your customers by placing fraud prevention guidelines on your website or by regularly sending a newsletter talking about fraud prevention.

This will not only educate your customers but can also be seen as a sign of goodwill and trust from your company.

Here are some of the information you should be educating your customers with when it comes to fraud prevention:

- If you did not initiate the call, do not give out any personal information over the phone.

- Give sensitive information to no one on the Internet or in the real world unless you initiate contact with the entity.

- Immediately report and replace stolen credit and debit cards, as well as driver’s licenses.

- Monthly financial statements should be reviewed.

- Never share your PIN or password information.

- Use strong passwords and change them on a regular basis for their financial accounts. Use a different password for each site or account.

- On your devices, install antivirus and antispyware software.

Alongside educating employees on the consequences of fraud, a cybersecurity team and system should be installed within your organization to provide a multitude of layers of protection to your organization and your customers.

| The Cyvatar Platform not only provides you with a dedicated cybersecurity team but also gives the cybersecurity training that your organization needs. |

- Invest in Cybersecurity

Most businesses prefer to integrate cybersecurity as part of their IT teams. By doing so you add in too much workload to an already pressured IT department.

Investing in a separate cybersecurity team and software can greatly enhance the protection of your business and digital assets, not to mention critical customer data like credit card numbers and social security numbers/addresses, etc.

Having a cybersecurity team ready to go allows you to mobilize and react to not just fraud but data breaches and online threats like hackers in real-time. A cybersecurity team can also run constant internal checks to ensure there is no malicious activity happening within the ranks of your organization.

A full-fledged cybersecurity team can bolster your security as they usually follow the latest security protocols, use the latest software, and uphold the highest standards of compliance when it comes to the security of consumer data by regulatory bodies.

A cybersecurity team can also implement services like transaction monitoring when it comes to a financial institution. Transaction monitoring allows your organization to monitor the transfer of funds and helps in the detection of unusual transactions of large amounts of money or even limits the amount of money that is allowed to be transferred between accounts.

In the case of fraud, these services allow easy and quick access to the malicious parties involved and also be quick enough to reverse or stop the transaction before it’s too late.

A Fully Managed Security Service provider such as Cyvatar can help with:

- Vulnerability Management

- Patch Management

- Continuous Remediation

- Endpoint Security

- OFAC Checks

When new customers, whether individuals or businesses, open accounts, they should always be subjected to an OFAC check to ensure their legitimacy.

You should also run OFAC checks on your entire name and address database regularly.

You can delete old customer information from the system if you have the right digital system in place. This ensures that no orphaned names remain on the data files.

It should speed up and simplify the process of adding new customers and retrieving customer information.

- Be wary of Insider Threats

While you might be convinced that most fraud is conducted because of external forces or factors, there is always the possibility that someone within your organization is capable of committing fraud.

The objective of managing insider threat is to ensure that it does not happen in the first place.

The best way to prevent insider attacks is by a proper screening of potential hires and employees.

Use careful hiring practices, run thorough background checks, and even have multiple culture rounds before hiring a potential employee.

It doesn’t end there, you need to have a workflow in place that has checks and balances with dual and triple controls to ensure that there is minimal risk.

On a personal level, you need to be open and inculcate trust in your employees. An attitude change or negativity can be telltale signs of someone who could commit fraud as a way to get back at the company.

A disgruntled employee has the potential to commit fraud down the line, so it’s best to be observant and cordial with your employees.

Banking Fraud via Phishing Scams

In this day and age, the unsuspecting user can be a victim to data breaches, cyber-attacks, and financial loss all by clicking a suspicious link, attachment, or email.

Cybercriminals have innovated to an extent where they can send you almost legitimate-looking emails which contain malware and methods that can retrieve your financial information or even ransomware.

Cybercriminals can send you emails and impersonate your bank, credit card company, online retailers, and even government agencies.

They use these trusted personas to get you to download a malware-ridden link or attachment, which then can get hold of your personal and financial information.

But all is not lost. By looking out for these red flags, you’ll be able to spot a phishing scam attempt:

Threats and Demands

Is the information request from the email/message legitimate? Your bank will never send you a threatening email or call you demanding information such as your password, credit or debit card number, or mother’s maiden name.

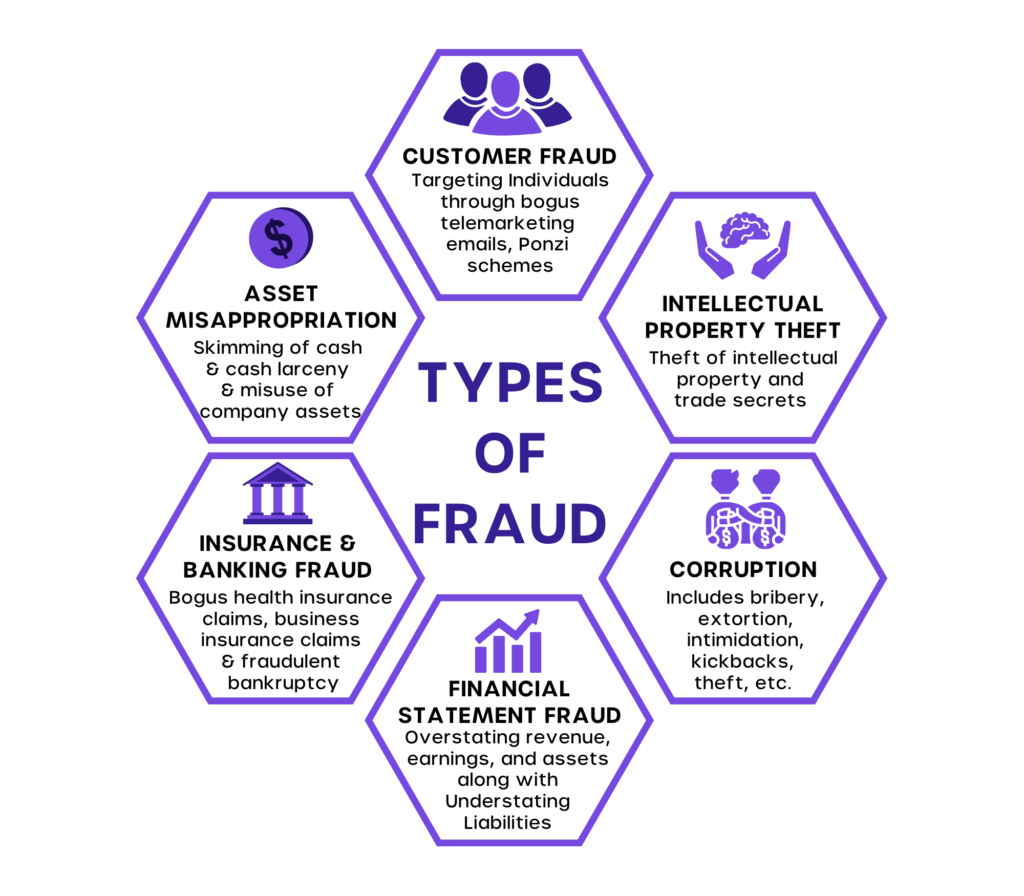

Warnings

Warnings that your account will be closed or your access will be restricted if you do not respond are a sure sign of a phishing scam.

If you are browsing a website, your browser may give you a heads up about a phishing website. Keep your web browser updated to help yourself ward off any phishing website.

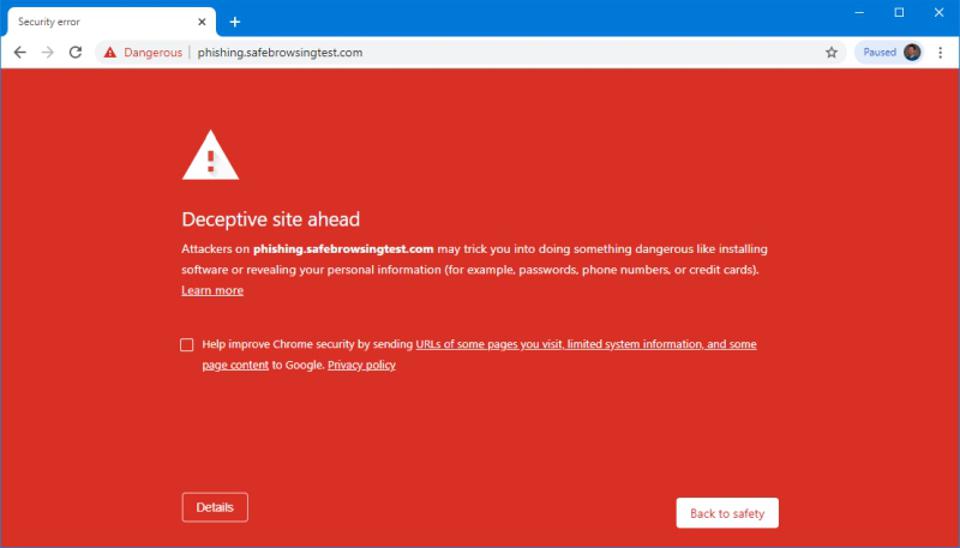

Suspicious Senders

Examine the “from” address. You can see the actual electronic email address if you hover your cursor over the name.

Some phishing attempts use a sender email address that appears legitimate but isn’t – one red flag is when the email domain doesn’t match the organization from which the sender claims to be.

Alternatively, you can check SPF records and DKIM signatures to validate if the email was signed and sent from the right sender.

You can see this in Gmail by clicking on the “Show Original” on the top right 3 vertical dots of the email opened.

Suspicious Attachments

Phishing emails frequently include embedded links that appear legitimate, but when you hover over them, you can usually see the true hyperlink.

If the hyperlinked address differs from the one in the email, it is most likely a phishing attempt. Is there an attachment in the email that you weren’t expecting? Never click on any suspicious attachments.

How does one protect themselves from Phishing Scams?

Phishing scams are a tale as old as the birth of email. So while phishing attempts have grown more sophisticated (poor spelling and grammar is no more a telltale sign!)

There are a few sure-shot steps you can take to ensure you never get caught up in one.

- Keep an open mind. Fraudulent emails can appear to be sent from a legitimate bank email address.

If you are unsure whether an email is from your bank or a reputable organization, contact them before responding to ensure that it is genuine. - Sending or confirming personal or financial information via email is never a good idea.

- Always enter your bank’s website using an accurate website address (URL). If you are unsure, contact your bank to obtain the correct website address.

- Always check the domain name linked in the email. On clicking the link if the domain name does not match the one listed in the email, it’s most likely a fraudulent website and must be avoided.

- Regularly check your bank transactions and credit card statements to be sure that all of them were only made by you. Contact the authorities and your bank if you find any discrepancies.

- Check your credit reports at least once a year by consulting a credit reporting authority just to make sure.

Cybersecurity for Fraud Detection. The Best Solution?

While fraud is a threat that needs constant attention and can happen both internally and externally, to your customers and you, it isn’t the only threat an organization has to handle.

Investing in a cybersecurity division or software greatly bolsters the level of security your organization has. It allows you to protect your data from malicious parties like hackers and cybercriminals.

There’s more to stealing than just money from your organization. A hacker could steal your intellectual property, steal valuable information about your customers like their social security numbers, credit card details, email addresses, and contact information.

Hackers can steal your company data and find out more information about your clients and investors and then aim to steal their data, damaging the reputation of your company.

Worst of all, when there is a data breach, you lose the trust of your customers, and unless you have a lot of money and time, it’s very difficult to gain trust back.

To fix it all, what you need is a complete holistic approach to secure your Bank and other financial institutions. Get in touch with our banking cybersecurity experts to guide you to manage the pitfalls of business fraud.