How long does an ACH transfer take? | Understanding ACH transfer

How long does an ACH transfer take? | Understanding ACH transfer

Cyvatar | 01/07/2022Per National Automated Clearing House Association (NACHA), as many as 27 billion transactions worth USD 62 trillion occurred in 2020. This was a jump of 11% from the previous year.

In that, there was a 42% increase in peer-to-peer transfers via ACH using apps such as Cash app and Venmo.

When money transfer happens between banks, ACH is the most preferred way.

Understanding ACH and How ACH transfer is made

What is ACH?

Ever wondered how payment platforms like Paypal and Venmo provide transfer of funds so seamlessly? Well, the magic behind the process is via ACH transfers.

Automated Clearing House more commonly known as ACH is an electronic money/fund transfer between banks that allows funds to be pulled from accounts and then pushed forward digitally/online to other bank accounts/ accounts from other banks.

In today’s time, ACH transfers are the preferred method for financial transactions online. ACH transfers account for your bank deposits, online bill payments, and other financial transactions that can occur online.

So What is an ACH Transfer?

Simply put, the electronic movement of funds between banks using the ACH network. As mentioned above many third parties like Paypal and Venmo make use of the ACH network. Coincidentally, even Government bodies like Social Security also utilize the ACH network for transactions.

For a fair idea of what kind of transactions occur via the ACH network, here are a few examples:

- External Fund Transfers

- Person to Person Transfers

- Bill Payments

- Employer Direct Deposits

- Government Benefit Programs

- Business to Business Transfers

What are the kinds of ACH Transfers?

Transactions in the ACH network are mainly processed in two ways.

- ACH Credit Transactions

Credit transactions in the ACH network allow you to push funds digitally/online to accounts from different banks.

It can be either to accounts you already own or to friends and family accounts. - ACH Debit Transactions

Debit transactions in the ACH network allow you to pull funds from an account.

So when you set up automatic payments or auto-pay bill payments for services like your Spotify or your Netflix account, it allows those companies to regularly deduct money from your account as payment (the money owed of course!).

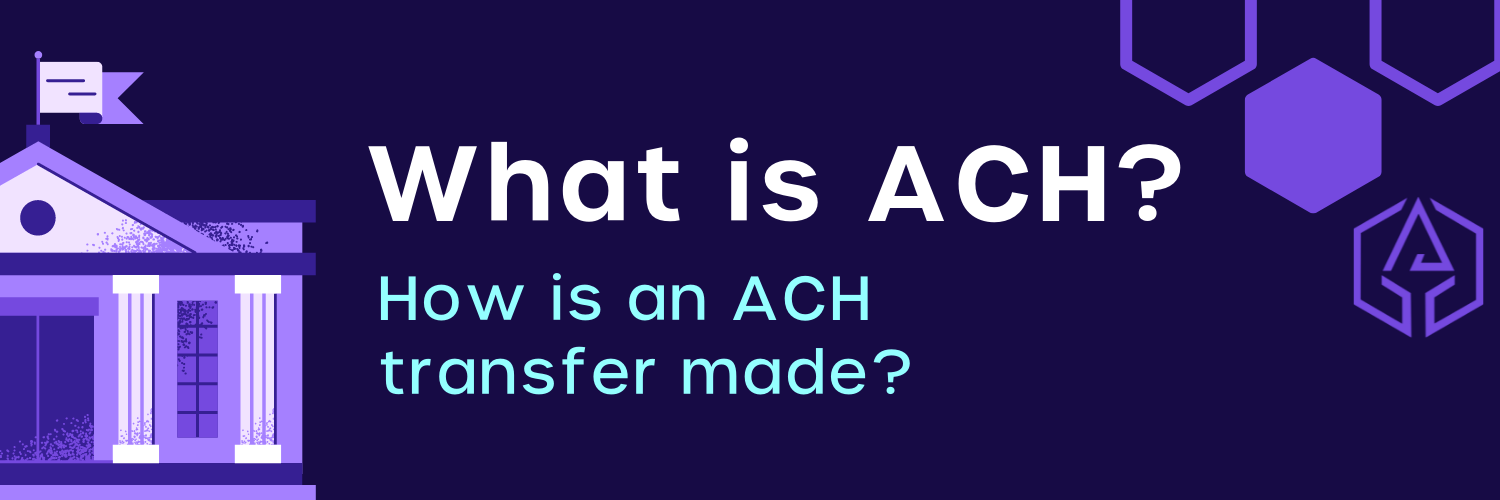

So how does an ACH Transfer work?

Here’s where it gets quite complex. Think of ACH transfers as a form of bulk mail.

Each fund transfer request is compiled as one message within a large batch of outgoing digital mail bundles from the requesting bank.

The bank making the request is known as the originating depository financial institution (ODFI)

The ACH network then repackages these large batches of transactions by a receiver and then distributes them to the bank that receives the requests.

These banks are the Receiving Depository Financial Institution (RDFI).

These transactions usually occur at five scheduled intervals every business day. The latest schedule for ACH transfers occurs at 6 AM, 12 PM, 4 PM, 5.30 PM, and 10 PM ET.

Now there are several factors that affect how these transfers work:

- Transfers vary based on whether they are a Debit or Credit request

- Transfer rates and timelines can vary based on the chosen processing partner

- Transfers can also be based on whether the originator has paid for expedited services (like same day service etc)

- Whether the initial transfer request comes back as a failure or an error.

How long do ACH Transfers take?

ACH transfers can take a few hours to a certain number of business days to process. The difference in time mainly depends on the following factors:

- Transfer speeds can differ based on the time of day of the transaction

- Whether the transaction request has same-day service benefits

- Whether the transaction either fails or returns with an error code

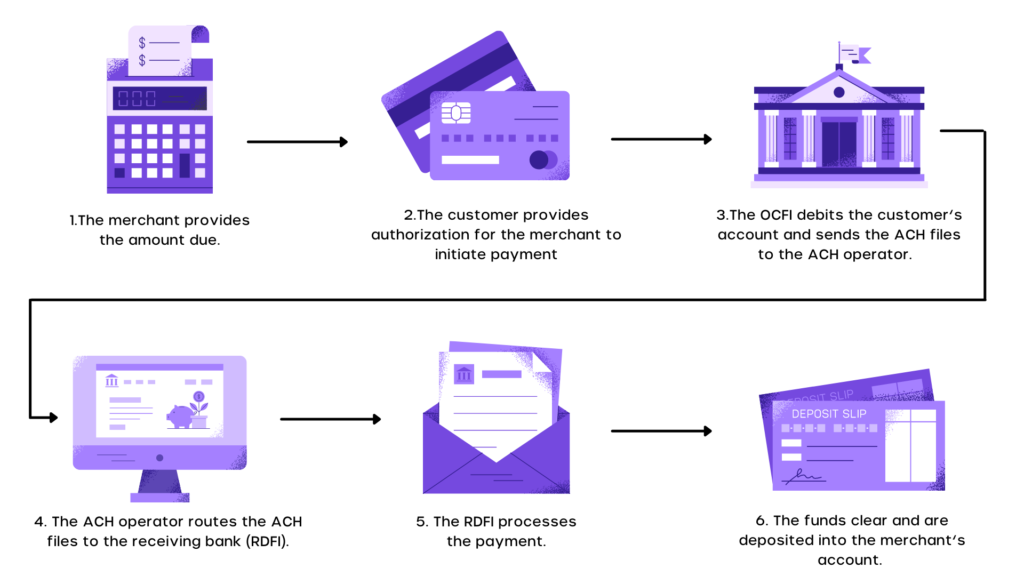

Below is the typical timeframe for Credit and Debit ACH transactions.

The delivery of ACH transfers can vary from immediate to several business days (because of situations such as banks not being open or operational on holidays and weekends).

Because these transfers are run by a network operator at certain times of the day, they cannot be done at any time and instantaneously like a wire transfer.

Banks and financial institutions have the option to have ACH Credit transfers processed within the same day or two or three business days.

On the other hand, the financial institutions can only process ACH Debit transactions on the following business day.

The National Automated Clearing House Association (NACHA) sets these timelines to adhere to.

NACHA is the trade group that oversees the ACH network. Financial institutions have a strict set of rules to follow set by the NACHA as well.

ACH Transfers vs Wire Transfers

You must be thinking about which is the better option to make a transaction. ACH transfers and Wire Transfers have many benefits to their own, but let’s compare them:

| ACH Transfers | Wire Transfers |

|---|---|

| ACH transfers are usually free and will only cost $2-3 for same-day or expedited services | Wire transfers cost much higher, ranging from $10 to $35 for domestic transfers and up to $50 for international transfers |

| ACH transfers take a lot of time to process and can range from the same day to several business days | Wire transfers in the US can be transferred and received within hours and often can occur within a few minutes from initiation |

| ACH Transfers unfortunately cannot be used to make international transfers. They are solely domestic and can only be used within US accounts | Wire transfers are the best and most common option for international transfers. They have additional costs and are the fastest and safe way to transfer funds outside the country |

| ACH Transfers are always done in specific batches throughout the day. This is the reason for a longer turnaround time | Funds via a wire transfer are usually cleared before the money even reaches the recipient’s account |

| The process is automated as well | However, the process is not entirely automated and a bank employee needs to finalize the transfer/funding |

Limitations of ACH Transfers

While ACH transfers are free and reliable, there are quite a few limitations as well. Do keep this in mind when prioritizing your transfers:

- Transfer Amount Limit

ACH Transfers have a daily and monthly cap on how much money one can transfer.

- Cutoff Timings

As ACH transfers work based on bank timings and batches, you need to make transactions at certain times to ensure quick processing. For eg: if you request on a Friday evening, your transaction will only occur on Monday.

- Fee for Insufficient funds

In the case of having insufficient funds for the transaction, your bank will charge you a fee and even stop the transaction entirely.

- No International Transactions

Most banks will not allow transactions to foreign accounts outside the US via ACH

- Saving account transfer limits

ACH transactions will only be free for the first six transactions for a US savings account. Any transaction made after six times will incur a convenience fee. This limits the free benefit of ACH transfers for savings account holders.

Is ACH transfer safe?

Nothing is fraud-proof in this digital world, however, there are a few pointers that you must keep in mind:

- Use a separate credit-only account for issuing ACH transactions. Do not allow any debit transactions from this account

- Know your vendors well and keep an eye on suspicious transactions

- Set limit and review periods on ACH transactions

- Keep the updated versions of anti-virus and anti-malware programs on the desktop where you process the payments

- Make sure the emails that you open are from the intended source. Check for misspellings and domains of emails before opening attachments if they are asking for details that look suspicious

- Stay up-to-date on news of topics related to ACH and have discussions with your employees about the same

Some examples of ACH fraud

- A cybercriminal accesses a customer’s details, generates an ACH file in the name of the originator, and then quickly withdraws fund

- A fraudster steals a customer’s credentials and registers himself as a bill payment recipient

- An insiders threat scenario where the employee of the company or bank modifies the ACH files

- A spear-phishing scam where an employee receives an email with authorization for ACH transactions leading him to an infected website and letting the criminals install keyloggers. The cybercriminals use it to withdraw funds as a legitimate user

Will ACH benefit your business?

We’ve spoken in detail about how ACH can be beneficial to a consumer or an individual.

However, to know if ACH transactions would be beneficial to your business, your answer needs to be YES to the following questions:

- Does your company/business rely on recurring payments from customers?

- Do a large proportion of your consumer base pay via credit card?

- Are your current and potential consumer base uncomfortable with paying via credit card online?

- Do a large proportion of your consumer base pay via credit checks?

- Is your business high risk and currently ineligible to accept credit card and debit card transactions?

- Do ACH transaction fees seem much more cost-effective than credit card fees?

- Are you able to convert your consumer base to switch to ACH from credit?

If the answer to these questions is YES, then ACH will be a benefit to your business venture.

Cyvatar for FinTech

If you are already worried about ACH implementation, it makes sense to be even more worried about its security.

Cyvatar’s managed services take care of all the security woes and provide you with cutting-edge technology to secure your fintech organization.

Connect with our fintech cybersecurity experts to help secure your organization. Alternatively, you can also start with a Freemium plan and try it for 30 days risk-free.