10 Ways Data Science Fuels Fintech Revolution In 2022

10 Ways Data Science Fuels Fintech Revolution In 2022

Cyvatar | 12/16/2021Data is the most profound source of credible decision-making. Data can never go wrong. Hence, the implementation of the data-based decision is going to set your FinTech organization in the right direction.

“Simply put, if AI is the artificial brain then big data is the neurons of the AI.” Artificial Intelligence works better when it gets to learn more with Big Data.

Data science uses scientific methods, processes, algorithms, and systems to extract knowledge and insights from noisy, structured, and unstructured data and apply knowledge and actionable insights from data across a broad range of application domains.

Financial technology, popularly referred to as FinTech, is one of the fastest-growing areas in technology innovation and aims to compete with traditional financial methods in the delivery of financial services.

Fintech refers to the integration of technology into offerings by financial services companies in order to improve their use and delivery to consumers.

Fintech’s data science refers to accessing and analyzing the thousands of Terabytes of structured and unstructured data that could be utilized by financial institutions to predict consumer behaviors and hence develop strategies accordingly.

How is data science going to impact the FinTech sector in 2022?

Fintech companies heavily depend on machine learning, artificial intelligence, predictive analytics, and data science to simplify financial decision-making and provide superior solutions.

Data science could help FinTech in the following ways:

- Payment and transactions

- Credit risk evaluation

- Revenue and debt collection

- Customer journey attribution

- Fraud detection and prevention

- Portfolio optimization and asset management

- Corporate compliance & service quality

- Robo-Advisors

- Insurance products

- Customer segmentation, retention, and loyalty programs

1. Payment and Transactions

Analysis and prediction of transaction volumes are key to enhancing product value for customers.

Data science makes evaluation of customer’s payment and purchases history to be evaluated at granular level making classification of payment records. This allows banks to customize additional services to their client’s needs.

Stripe, Square, Venmo, Braintree, Wise, and Circle are some fintech companies that use data science to give customized offers to customers based on their transaction history and purchasing power.

2. Credit Risk Evaluation

FinTech and other startups are in a rush for clients and venture capital money. Credit risk assessment is a great way to filter who is creditworthy and who is not. This sharply lowers the credit risk.

Data science allows us to precisely determine the creditworthiness of an individual by evaluating some 15,000 data points.

3. Revenue and Debt Collection

With credit risk assessment, it’s possible to evaluate who is worth giving money to. Data science helps with accurately assessing the payment schedule of a person. Hence, making a smooth revenue and debt collection.

Per a report from ibisworld.com, the total size of the market for debt collection is $18.6 bn USD in 2021 which has increased by 4.4%.

It has been growing by 3.3% per year for the past 5 years. This data suggests how significant it becomes to have an advanced system in place that accurately assesses the revenue and debt collection. Data science plays a key role in achieving that.

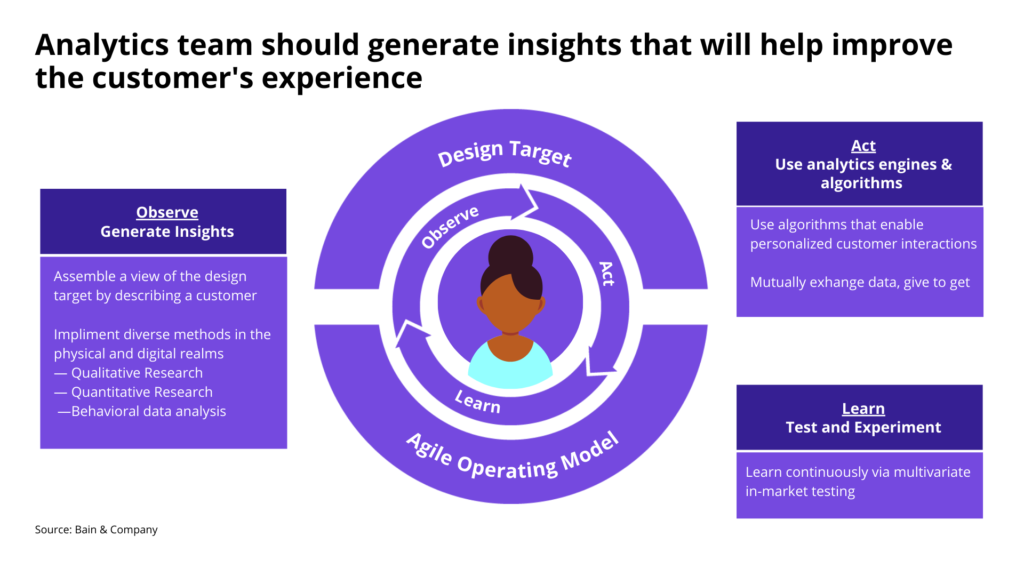

4. Customer Journey Attribution

Data science helps financial institutions generate customer profiles by analyzing multiple data points.

This allows offering highly targeted and customized customer services and customer experience. For example, the algorithm could suggest upselling or cross-selling to a particular customer based on initial signup.

The business can easily retain customers by automatically offering services depending on location and demographics.

For any business, customer acquisition costs and customer lifetime value are important considerations. Data science makes it possible to easily and accurately measure those metrics.

5. Fraud Detection and Prevention

With the advent of the pandemic, cybercrime has been on the rise. There has been a significant rise in ransomware and DDoS attacks during the COVID-19 outbreak.

Per a report by Interpol, 67% of the member countries that responded to a cybercrime survey admitted that there has been an increase in phishing and online fraud utilizing COVID-19 themes.

Data science enables monitoring transactions in real-time and flagging the ones that fall outside of the average. Data science not only enables the early detection of anomalies but also the prevention of any possible cyber attack.

With such serious threats looming pandemic, fraud detection and prevention ought to be the top priorities of FinTech executives.

Cyvatar’s solutions are built on utilizing data science, harnessing the power of AI and machine learning, to provide end-to-end protection.

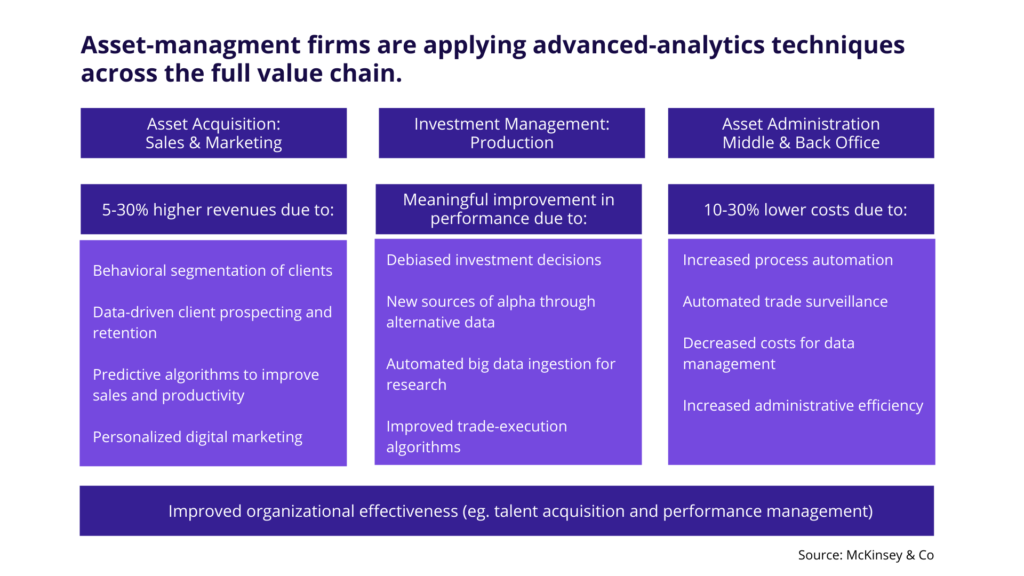

6. Asset Management

Data science gives insight that can find potentially outperforming equity by identifying new patterns in the existing data sets.

Per a study by McKinsey, with the use of advanced data analytics, asset management firms are able to boost revenues up to 30% and reduce costs up to 30%

Asset management could be tricky. And if you are not sure where to start, we are here to help. Learn more about Cyvatar’s asset management.

7. Corporate Compliance & Service Quality

Big Data is critical for big businesses and FinTech alike. With the help of data science, various measures could be implemented to track the staff behaviors across the organization to see if they comply with the laid down policies.

This becomes even more important if your organization has different regional branches. To ensure high-quality standards across locations, you must utilize the data science to observe any anomalies in the system and fix them before it’s too late.

In a notorious case, Australian bank Westpac was fined a whopping $1.3 bn USD for non-compliance with anti-money laundering regulations.

8. Robo-Advisors

Robo-advisors provide algorithm-driven, automated financial planning, and investment services to investors. They are the automated bots running heavily on Big Data.

Most of the process is technology-driven and automated. It begins with the collection of information through online surveys. This helps create a customer profile that includes their financial status, goals, and risk capacity.

With the help of data science, the software is able to take various actions such as offering financial advice. Furthermore, it can also make investments on the client’s behalf based on the instruments that best suit their investment goals.

Companies such as wealthfront and Vanguard use data science to provide customized and automated investment solutions.

9. Insurance Products

To create a personalized risk assessment, insurance data scientists may combine analytical applications such as behavioral models based on customer profiles and a continuous stream of real-time data from weather reports, satellite data, and vehicle sensors.

This gives a clear and detailed assessment of risks related to insurance products.

The magic of data science can help predict the future as precisely as possible. This ensures precise claim prediction and possible reduction in the company’s loss.

Per the FBI’s report, insurance fraud is on the rise and is costing $40 bn per year, already.

The insurance industry can very well utilize the data science to assess risk and offer services. It could be the auto insurance industry, property insurance industry, or life and health insurance industry, data science is critical in the success of these sectors.

10. Customer Segmentation, Retention, and Loyalty Programs

Who doesn’t want to retain customers? Customer retention programs have to run through a mind-boggling data analysis process.

Big Data provides predictive analytics and prescriptive analytics that help find possible negative interactions from customers, possible outcomes and then tries to provide solutions before the customers could become retractors.

It makes sense to analyze the current data of your most valuable customers and learn what traits of the customers are similar and which are not.

Customer segmentation helps banks group their customers based on specific behaviors & characteristics and eventually address them accordingly.

Machine learning techniques like classification and data clustering help in determining potential customers and reward the existing ones for achieving a set of goals.

Proper use of data science leads to retention, club it with a relevant customer loyalty program and you can have lifetime happy customers.

Leverage Data Science & AI to safeguard your organization

Cyvatar’s solutions use data science and AI to provide customized cybersecurity solutions for every organization with affordable pricing. Learn how this impacts the bottom line of businesses that prepare for cybersecurity threats. Connect with one of our cybersecurity experts now to plan for your requirements.