AI in finance 2022: 10 ways AI is transforming the finance Industry

AI in finance 2022: 10 ways AI is transforming the finance Industry

Cyvatar | 02/11/2022Not many technologies have had the kind of impact that artificial intelligence has had in the 21st century. From recommending movies and web shows on Netflix to analyzing a patient’s medical record to identify potential treatments, the use cases are endless.

The impact that AI has on the business world, and on the common people, is incredible.

Any industry you name must get more out of AI to improve its process and operational efficiencies. The banking and financial services industry has undergone a massive transformation, thanks to AI-powered applications.

There was a time when you had to wait in line for hours to get a few transactions done or wait weeks to get back the status of your loan application. All of this has changed, and how!

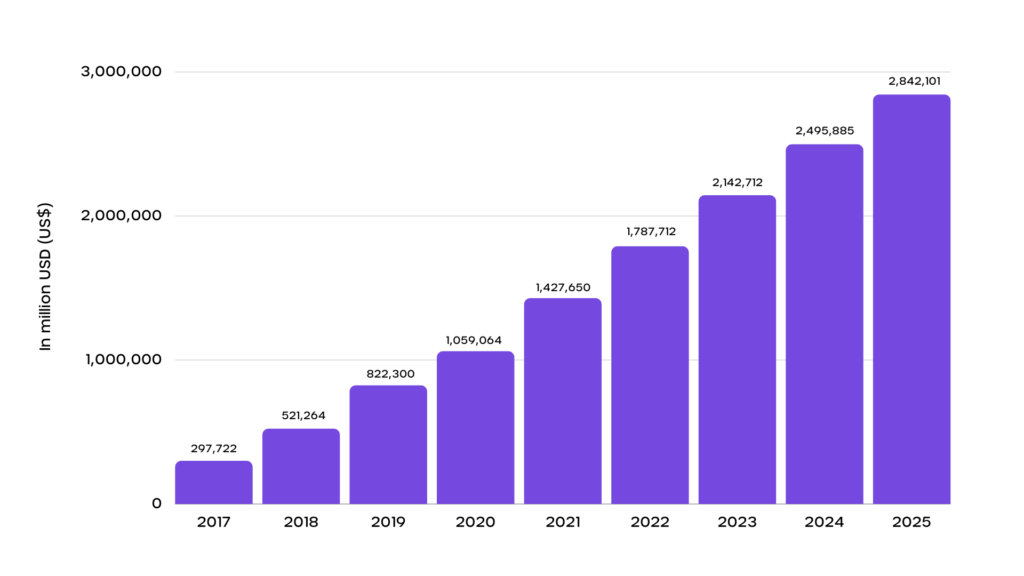

McKinsey estimates that AI technologies could deliver a value of $1 trillion each year, for global banking.

From increasing revenues through increased personalization, lowering costs by automation, and finding new opportunities by analyzing millions of data points, the applications of AI in the banking sector are numerous.

Let’s analyze the top 10 ways AI will transform the finance sector in 2022

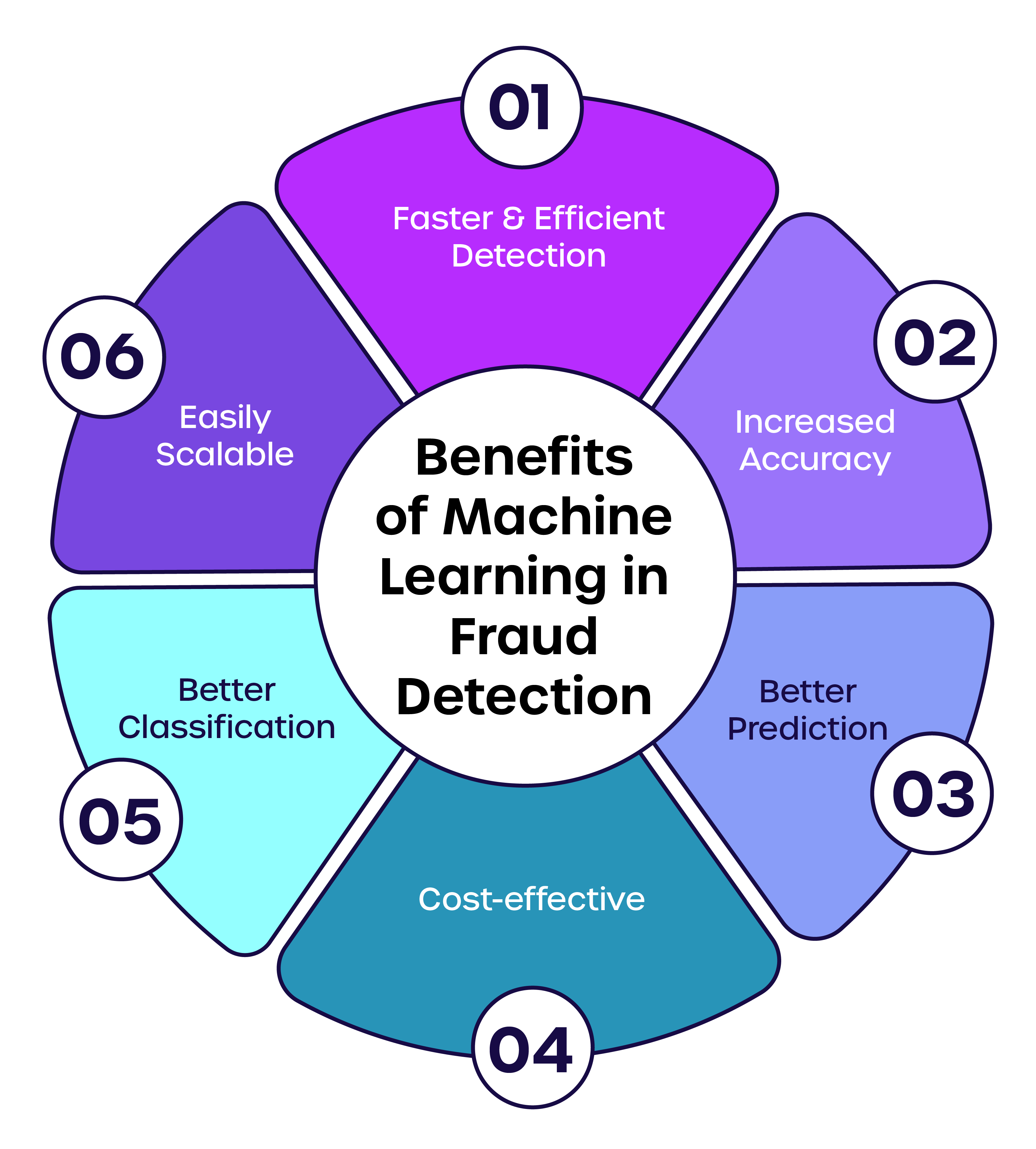

1. Fraud Detection

According to IBM, 72% of business leaders say that fraud is a growing concern, and the worldwide losses from it are pegged to be $44 Billion USD, by 2025.

Fraud in the banking sector could constitute anything from loan application fraud, false insurance claims, credit card fraud, or even organized crime.

No matter what the size of the financial institution, be it a global organization or a small NBFC startup, everyone is susceptible to fraud.

Artificial Intelligence has the capability to make frauds in the banking sector a thing of the past, or at least reduce its instances.

AI algorithms are capable of detecting anomalies in transactions or unusual patterns. While subtle deviations might not sound alarming to humans, AI systems are capable of classifying every single instance.

AI can leverage past spending behaviors to point out odd behaviors. Let’s say a customer transacts in a different country, where various amounts are debited within a short span of time.

Then that is an unusual behavior that the AI detects because the card is used outside of their usual location and the customer can be alerted to change their PIN and banking passwords while freezing the card for further transactions based on customer input.

The AI system is also extremely good at learning and improving itself. If a red flag raised by it for a regular transaction is corrected by the bank’s personnel, then it learns from this instance and makes better decisions.

For every $1 that banks lose to frauds, the recovery costs are at least $2.92. That’s exactly why banks need to take the case of fraud extremely seriously- and more importantly, leverage AI to do it.

2. Monitoring and Collections

With the help of AI and advanced analytics, banks can reduce the burden of non-performing loans. Banks engage proactively with customers to ensure that they keep up with the payments and reduce difficulties with payments if any.

AI algorithms use internal and external data sources to create a holistic view of a customer’s financial position. Therefore, they can gauge warning signals and are aware in case the risk profile of a customer changes.

Apart from using conventional data sources, AI systems even incorporate data from field visits, comments from collection agents, campaign data, etc., to draw insights for their collections strategy.

3. Better Credit Decisions

Providing credit to the right borrower to the right extent and for the correct period of time is the holy grail of most banking institutions.

Banks need to get this right, otherwise, they will find themselves staring at losses. The creditworthiness of an individual, until now, was decided based on past and current earnings, gender, race, previous repayment history, lifestyle expenses, and so on.

The process is complicated, and there is the added pressure of having to get it right.

Will AI solve the issue of loan disbursal? Yes. By using several data points, AI can build predictive models of an individual’s income-earning and repayment capacity.

It ensures that the decision to offer someone a loan or not gets taken fast. With this method, banks would be able to identify the accounts that will provide good returns while also showing those that have high chances of becoming a non-performing asset (NPA).

4. Cost Savings

AI is all set to provide the banking industry with savings of $447 billion by 2023. Banks use artificial intelligence to save costs in the front office, middle office, and back office.

In the front office, it saves costs with the help of conversational banking, AI biometrics technology, and personalized insights.

In the middle office, anti-money laundering, know-your-customer, and anti-fraud are the areas where cost savings happen. Credit underwriting and smart contracts infrastructure are where artificial intelligence saves money for the banks’ back office.

5. Capital Optimization

The main objective of capital optimization is to ensure that the bank always maintains sufficient cash flow to meet its short-term operating costs as well as short-term debt obligations.

Since working capital is the backbone of every bank, it needs to be saved through proper optimization without halting the bank’s day-to-day operations.

Reducing the cash flow is not really a long-term solution. Supply chain and financial workflows need to be optimized.

Maintaining and optimizing cash flow records is not an easy task as there are millions of numbers to oversee.

Thanks to data-driven AI and machine learning algorithms, not a single cash reserve goes missing. Initially, a small set of data is added to the AI platform, and then it scans the rest of the data.

AI algorithms approach capital optimization in two ways- the quick approach and the long-term approach. The former is an emergency measure to reduce cash outflow by avoiding non-profit expenditure, calculating surplus stock, optimizing cash returns, and reducing payments.

The long-term approach relies on maintaining supply chain accuracy, optimizing assets and liabilities, expenditure tracking, and fine-tuning the transaction processes.

It is expected that by 2025, 40 percent of revenues will be at risk in a few product categories if banks do not act quickly, according to a McKinsey report.

It will be because of regulations, capital requirements, and compliance costs. Banks will have to rethink their operating costs and see how they can deliver more value at a lower cost.

6. Risk Assessment

There are a number of statutory regulations for financial institutions. Being compliant with these regulations can be difficult, especially when services are provided across multiple geographies.

Even if you have a number of minds working together on it, maintaining total compliance when dealing with securities, insurance, debt, products, and other financial products can be incredibly difficult. This is where AI can be of huge help.

AI systems help improve the reliability of risk assessment by introducing systemized framework which doesn’t allow for manual errors.

The McKinsey Global Institute says that this could generate a value of more than $250 billion in the banking industry. Risk Dynamic, a model-validation arm of McKinsey has validated thousands of traditional models in different banking fields. It examines 8 risk-management decisions that cover at least 25 risk elements in the banking sector.

7. Hyper Automation

A term coined by Gartner, Hyper Automation refers to the use of advanced technologies such as AI to automate manual processes.

It not only increases the productivity in financial institutions, but it also lowers the operational costs by a huge margin.

The main objective of hyper-automation is to automate repetitive and manual tasks. This frees up the time for the bank staff who can concentrate on doing core tasks that are of high value instead of low-value manual tasks.

Apart from the above benefits, hyper-automation reduces human error as they follow a set of predefined rules.

Monitoring transactions, paperwork automation, KYC process, credit card processing, account closure process, automated report generation, customer onboarding, to name a few, are tasks that can be automated.

9. Financial Advisory Services

AI solutions deliver financial advice taking into the financial position of the customer. It accounts for their financial history, demographics, financial habits, and risk capacity.

Even information that is not readily available but required to deliver accurate financial advice can be collected with the help of a chatbot.

The details could be leveraged to fix up an appointment with an advisor or offer a product that could potentially save them money.

Even the smartest of minds will miss patterns, but an AI system does a pretty good job at recognizing them. They are naturally built to solve data analysis problems.

AI systems can distinguish real patterns from mindless chatter, collate relevant data and provide meaningful insights. Not to mention that they are self-learning, which means that it gets better with time.

The number of users who use AI to manage their assets is expected to grow to 478.89 million users by 2025 per a report by Statista.

The number will only keep increasing as the systems will get better with more time, and people will be more open to it after seeing the results.

9. Customer Engagement and Servicing

Banks can create a smart and highly-personalized customer experience based on customer micro-segments, powered by AI-decision algorithms. With micro-segments, different channels can be used to deliver superior service.

The experience of the customers will be simple and intuitive as they are directed based on their unique needs. With the help of timely insights, customers could be served with tailor-made offers, that too individually.

The productivity of agents could also be increased by making them recommend pre-approved products that meet the unique demands of each customer.

There are AI models which analyze voice and speech characteristics that match agents with customers according to behavioral and psychological mapping.

Transcript analysis by artificial intelligence systems can predict the mood of customers and can advise agents on how to offer solutions to the customer.

10. Instant Personalized Support

When it comes to customer service, banks and financial institutions are certainly not the first industry that comes to our minds.

Customers these days will not be happy with a lackadaisical approach to support. Thankfully, there is AI, to save the day for banks.

For customers who want immediate support, banks have AI-powered chatbots that not only respond to oft-asked questions but also have the ability to respond to complex queries.

Chatbots work on predefined rules. AI-powered chatbots have deep learning capabilities and learn continuously from customer conversations and previous data.

The best thing about chatbots is the convenience that they offer. It doesn’t require rest, works 24*7, and can handle any number of queries at the same time.

For banks that have thousands of customers, there is nothing as convenient as an AI-powered chatbot to offer instant support.

BONUS: Artificial Intelligence for Loan Underwriting

Artificial Intelligence clubbed with automation can speed up the process of gathering, reviewing, and verifying mortgage documents.

Loan underwriting is a risky job that involves sanctioning a loan after going through all verifications checks and ensuring that financial status requirements are met. It’s also the job of the lender to ensure that the borrower is able to pay the mortgage after all the expenses.

AI helps smoothen and speed up the whole process with fewer hiccups. Artificial intelligence can help pre-fill and analyze the application forms.

It can help identify application exceptions to enhance accuracy and alert mortgage officers real time of any issues with the application or applicant.

Managed AI-based cybersecurity for FinTech

When it comes to the applications of AI in the banking sector, we have just started to realize the immense possibilities. Financial institutions understand the kind of impact that AI can have, and are adopting the technology with open arms, and rightly so.

Cyvatar understands the needs of the FinTech industry and we have democratized cybersecurity to help organizations of varied sizes decide what solutions best suit their organization.

| Hit us up and connect with a CYBERSECURITY EXPERT now Ready to Try? GET STARTED WITH A ONE-MONTH RISK-FREE TRIAL |