What is opportunity cost and how to calculate it?

What is opportunity cost and how to calculate it?

Cyvatar | 02/02/2022“There’s no such thing as a free lunch” – a famous quote by Nobel Prize-winning economist Milton Friedman. This quote holds true in terms of what we call opportunity cost.

In the business world, opportunity cost is simply – The cost of the value of what one loses when choosing between two or more business options.

The concept of opportunity cost stems from an economy or situation of scarcity. Because at a time of scarcity, every decision taken becomes an opportunity cost.

A simple example of how opportunity cost works:

Kobe Bryant during the end of high school could have chosen to take up tuition with four years of college instead of signing for the LA Lakers.

His Opportunity cost would have been upwards of 10 Million dollars, seeing as that was his pay for the first few years as an NBA player.

This is also why star athletes don’t usually finish their College education and prefer a lucrative career in sports instead.

Another example would be:

To choose when to sell stocks?

Do you as an investor sell your stocks now and gain remuneration or do you wait for stock values to potentially rise even higher and then sell?

Quite a dilemma isn’t it?

What are the types of opportunity costs?

We know opportunity costs as economic costs or financial costs.

Opportunity costs are quite important to companies and businesses because of how it allows them to gauge and determine how to effectively manage their resources and funds while aiming to maximize and grow.

There are two kinds of opportunity costs a business can incur:

1. Implicit

Implicit opportunity costs are intangible costs the businesses incur and are ones that cannot be easily quantified or accounted for.

An example of an implicit opportunity cost would be when a company invests significant amounts of time and resources into nonprofit work.

Here the implicit costs would be the money gained or lost while spending time on volunteer work instead of regular work.

2. Explicit

Unlike implicit opportunity costs, explicit costs can be accounted for.

We usually calculate opportunity costs in monetary terms and value/ currency.

An example of explicit costs would be that of a company spending $500 on printers and printing material for its office and the employees.

Here the explicit cost is the amount of money spent on the printers and material or what the company could have spent the $500 for, instead.

How does opportunity cost work?

When faced with a business decision, the best course of action is to gauge the kind of returns you will avail of from the options you have.

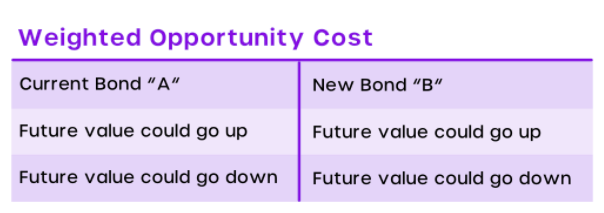

In this example, we will explore the scenario of selling one bond to purchase another with the money earned.

Let’s say your current bond (BOND A) is worth $5000, you can sell this to purchase a new bond (BOND B) which is worth $10000.

Selling Bond A can help lower costs when purchasing Bond B. This is where you will need to weigh your options.

The upfront cost of Bond B is double that of Bond A, so the main objective of purchasing Bond A is the hope to gain more as a low-interest rate can still provide increments.

However, on the flip side, to add value to Bond B, you will need to shell out an extra $5000.

So in this example, your objective is to receive continued interest gains on your current bond (Bond A) and the loss of $5000 incurred on Bond B in the hopes of recovery and increased profits in the future.

Decision-making costs other than the opportunity costs

Opportunity costs aren’t the only potential expenses a business incurs, there is also the case of incremental costs.

- Incremental Costs

There are times when businesses will intend to sell their product in its current state or process it further in order to generate additional revenue.

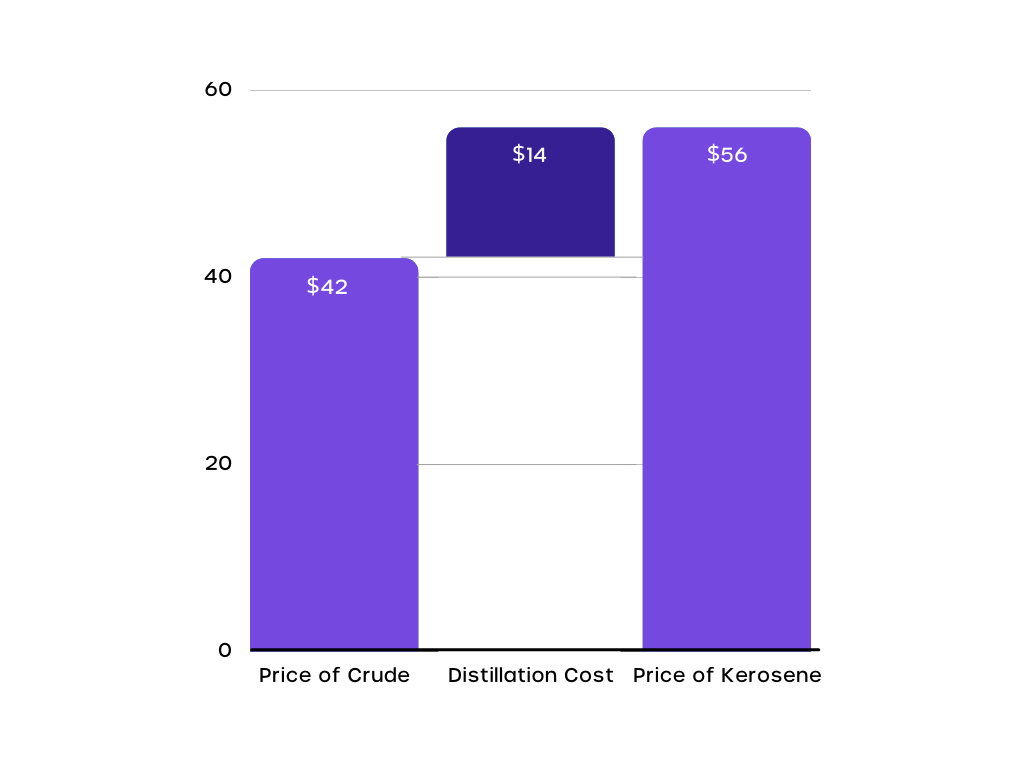

For example, an oil refinery can sell crude oil at $42 per barrel. However, the refinery chooses to refine its oil to kerosene (which sells for $56 a barrel).

While Kerosene sells much better than crude oil, it is up to the refinery to incur the costs of refining crude oil to kerosene and then determine its profitability.

The task of refining is profitable as long as the distillation cost of refining the crude oil to kerosene is less than $14.

If the distillation cost is higher than $14, it would be more profitable for the refinery to sell crude oil instead of kerosene.

Calculating opportunity costs and production possibilities curve

There isn’t a clear-cut method as to how to calculate the opportunity cost for a particular situation. Hence, opportunity costs may not always be easily accountable or quantified.

However, there is a predominant formula most businesses use to calculate the opportunity cost and is as follows:

Opportunity Cost Formula

Opportunity Cost = Return on best foregone option (FO) – return on chosen option (CO)

This formula is as simple as it gets. The difference between the expected return of each option a business has.

Opportunity cost is applicable for almost any decision a company takes.

Utilizing opportunity costs can help businesses determine the best possible recourse to maximize profits and use resources efficiently.

It also allows businesses to gauge the efficacy of a previously foregone option.

The production possibilities curve (The PPC)

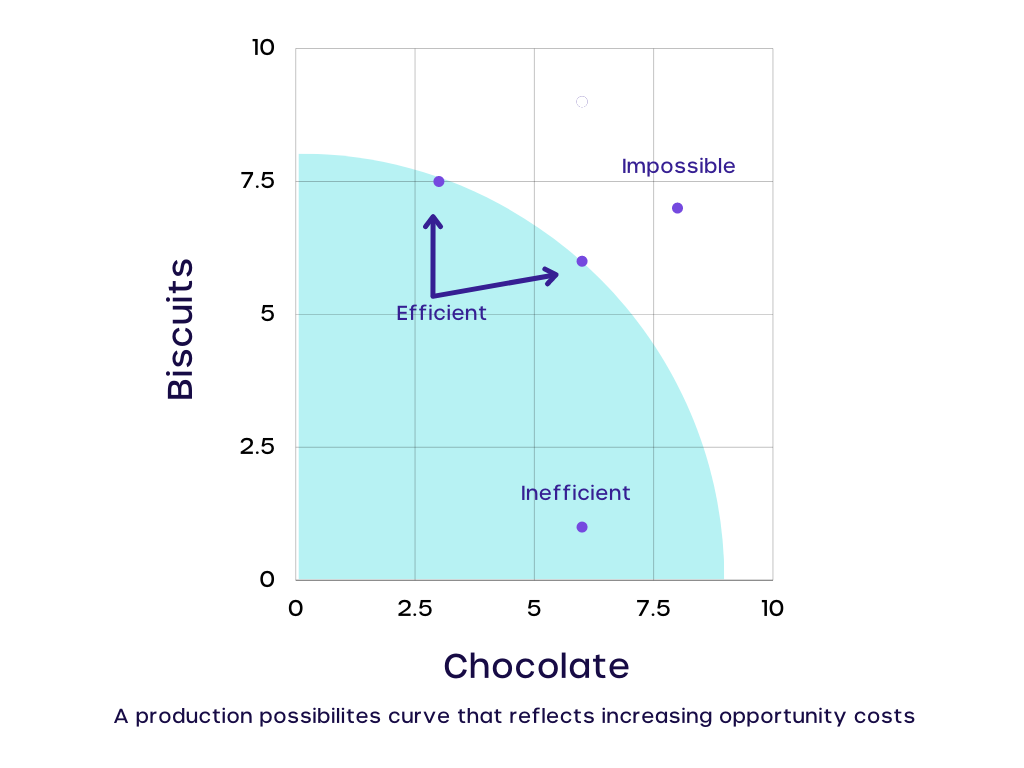

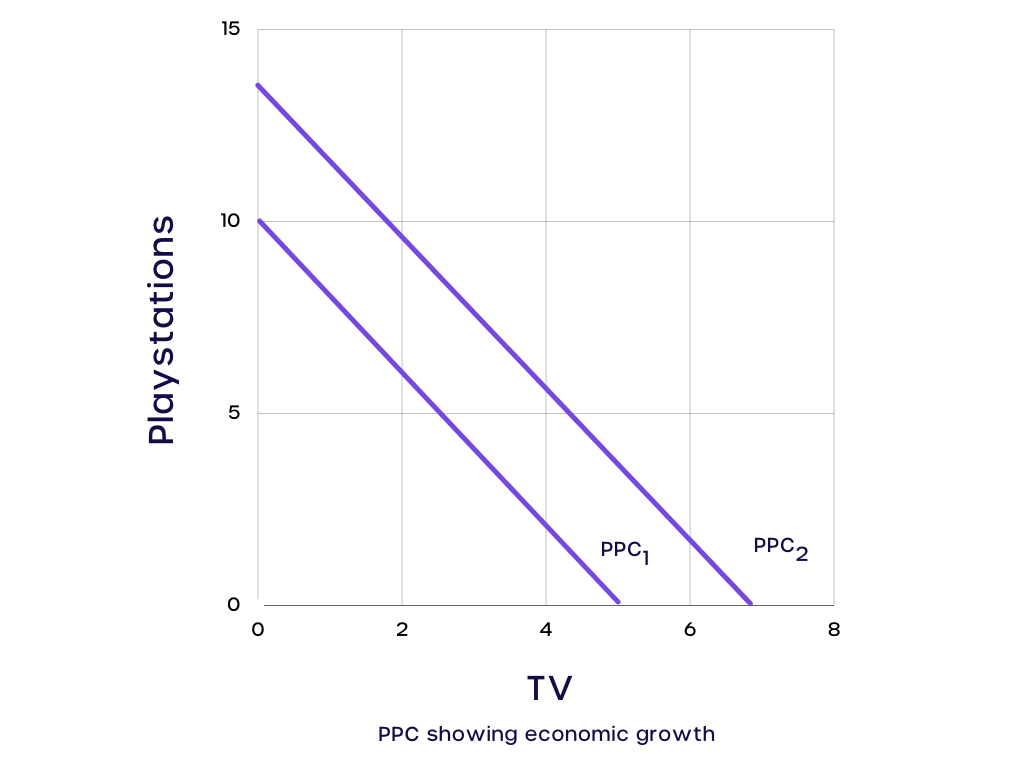

The production possibilities curve (aka production possibilities frontier) is a graph model used by businesses and economists to show the tradeoff when making a decision on resources invested between two goods. The PPC also helps with microeconomics.

It is an efficient model that helps businesses understand the scarcity of resources and their opportunity costs.

In terms of reading a PPC (Production Possibilities Curve):

- Points on the interior of the Curve are inefficient

- While points on the curve are efficient

- Points beyond the curve are impossible to achieve

The bowed shape of the curve in the graph below indicates that there are increasing opportunity costs of production.

We can use the PPC model to depict economic growth, which can be seen below via a shift of the PPC.

The graph below shows a business that has experienced economic growth.

The combinations that we once thought impossible, which in this case is 10 TVs and 4 Playstations, are now on the new PPC. This can be due to an increase in resources and innovation in technology.

Real-life examples of opportunity costs

We have already established that individuals, as well as businesses, can incur opportunity costs.

Let’s take a look at a few unique scenarios where opportunity costs can come into play:

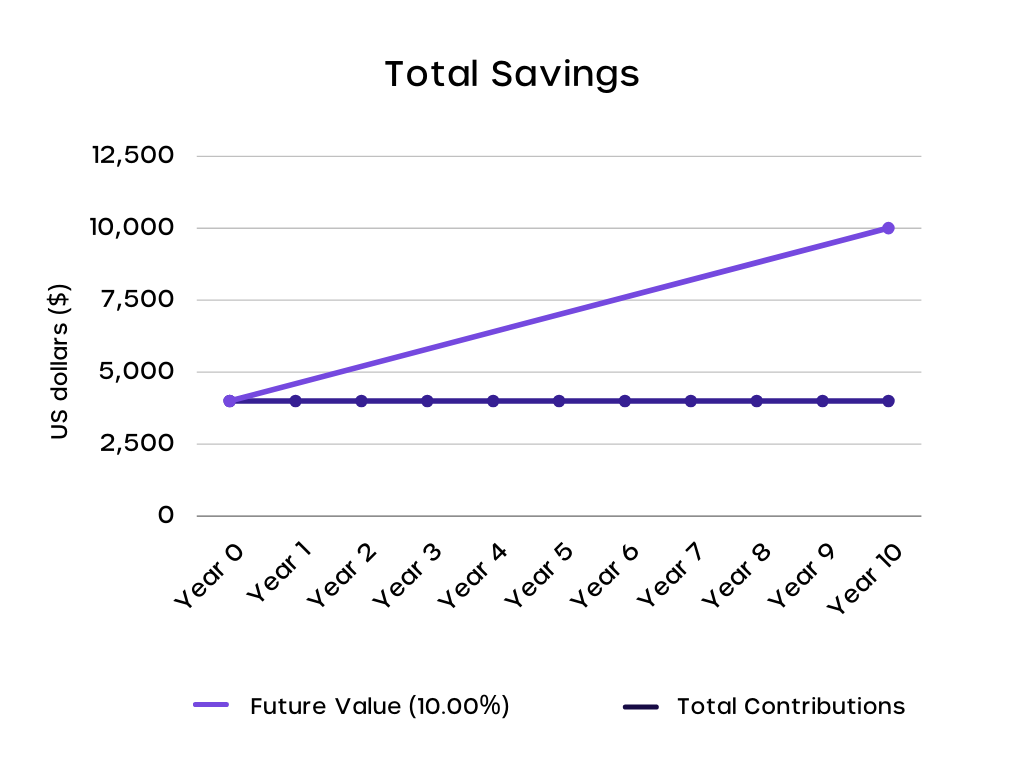

Example 1: You won the lottery!

Congratulations, you hit the jackpot and won $4,000 in a lottery! Now that you’ve got your money, you wish to go on a getaway to an exotic locale, after all, there’s no downside right?

However, if you decided to hold off on going for that impromptu trip and decided to invest your money in an income-producing resource with say a 10% interest rate, compounded annually. In 10 years, you could see yourself walking away with a cool $10,375 ($4,000 + $6,375 estimated returns)

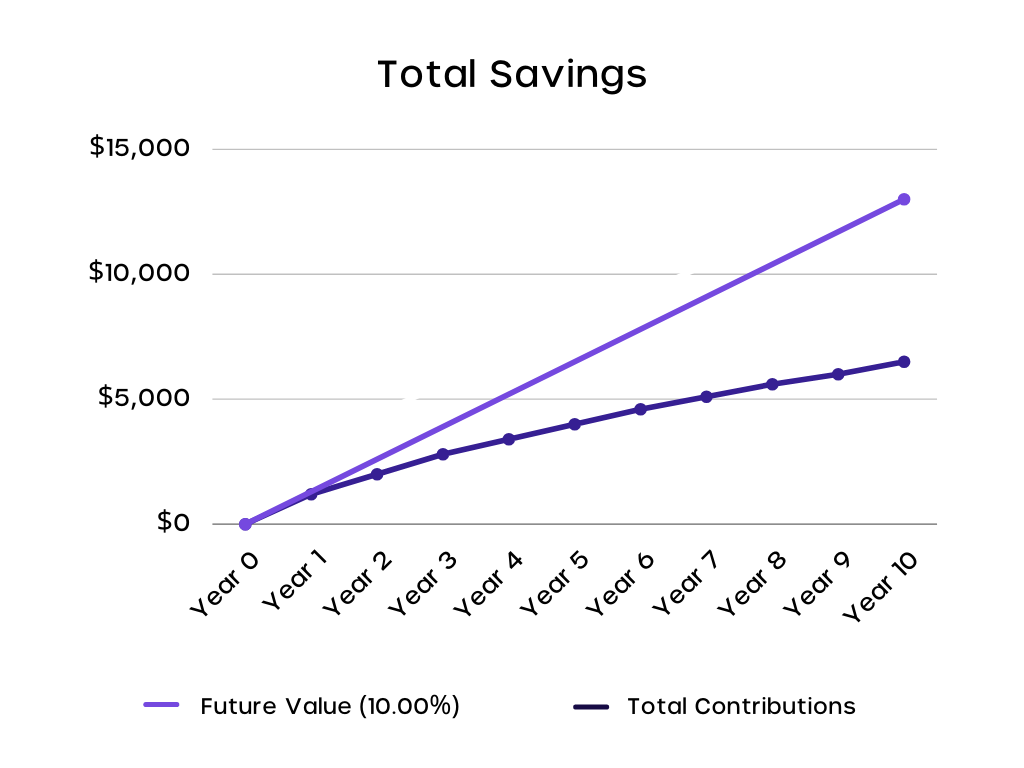

Example 2: Making small savings over time!

So far we’ve talked about one-time investment-related opportunity costs. But what about your daily purchases, would you gain more by investing someplace else?

Let’s talk about your thrice-a-week run to your nearest Starbucks. If your mocha caramel costs you $4.49, would put that $54 per month to better use?

If you regularly invested that $54 per month for a 10% compound annual growth rate (CAGR) in a fund and top up your monthly investment by 5% every year (mitigating the rise in inflation) for a tenure of 10 years- you’d most likely have your coffers filled with $13,466 at the end of the 10-year period. The final values will differ however as taxes and inflation do have their impact.

That said, hope you’ve got a better picture of opportunity costs.

Your circumstances can be different, you can start small with even a cup of coffee or a pack of gum every day to large-scale business decisions. Either way, opportunity costs are here to stay!

Cumulative opportunity costs due to persistent cyber threats

Everything an organization is today, it’s due to the decisions their decision-makers made.

You may have cybersecurity in place, however, you may not know how much opportunity cost it’s already incurring to your bottom line by not implementing fully managed cybersecurity services.

The only way to know is to try the risk-free 30 days free trial.

Cyvatar takes pride in providing fully managed cybersecurity solutions customized to each business’s needs. Have specific business requirements? Get in touch with our dedicated cybersecurity expert today; for lack of cybersecurity is too big of a cost to bear.